What you ought to Learn about College student Auto insurance

If you’re beginning your own very first 12 months within university, not having auto insurance isn’t a choice. It’s not some thing that you ought to think hard regarding simply because uninsured motorists that get involved with mishaps could be fined, shed their own permit, obtain a poor strike on the credit ratings as well as even worse, jailed. A person would not wish to give up on the vibrant long term through generating close to without having obtaining covered very first.

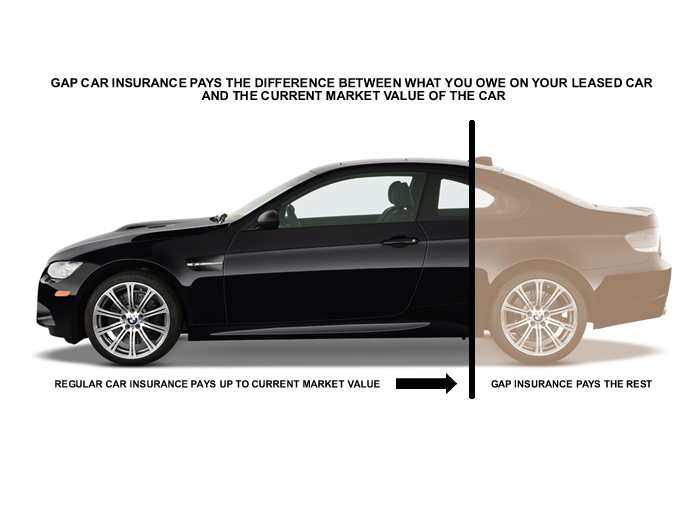

College student auto insurance safeguards an automobile in the event of any kind of incident or even accidents. Whenever a college student avails associated with insurance coverage, the organization concurs to pay for the actual payment for just about any reduction or even damage that could occur. Although individuals believe that it’s the waste materials associated with cash, it is a great expense. For instance, rather than needing to purchase a brand new vehicle in the event of any sort of accident, the actual insurance coverage may substitute this with respect to the conditions how the plan includes. Additionally, students auto insurance includes a so-called “maturity date”, the industry particular period once the vehicle doesn’t really incur any kind of damage. Whenever you achieve the actual maturation day, some from the cash that you simply taken care of the actual insurance coverage is going to be came back for you.

A few insurance providers tend to be much less rigid compared to others as well as are prepared to provide discount rates in order to college students along with higher levels or even along with excellent information. These businesses think that a great college report exhibits a feeling associated with obligation, and for that reason a much better self-discipline with regards to generating. Nevertheless, this particular low cost might be suspended when the individual given by using it is actually released the racing solution. Additionally, the actual insurance provider may request the individual to cover the entire high quality cost from the insurance plan. Consequently, if you’re provided the low cost through a good insurance provider, you need to look after this as well as maintain a great record before you move on.